Yep. We know. We’re just about the last people on earth to comment on this.

Imagine, if you will. (And if you’re round these parts often, you’ll find yourself doing this quite a lot. Stick with it. We’re making a point).

It’s a quiet, Tuesday morning in Britain. A drop of drizzle trickles down a second-floor window of a construction office building, tucked somewhere in a miscellaneous corner of a miscellaneous industrial estate hovering on the periphery of a commuter town.

It’s watched by a procurement manager. A mug of half-drunk coffee sits at their desk whilst they frown into a screen. They’ve noticed something odd.

Steel prices have twitched again. Not violent enough to be considered a shudder, but it’s a definite movement. The kind that means something, somewhere, is happening. Possibly involving the Americans.

Elsewhere in the building, a headline drops. US to reintroduce steel tariffs.

Meanwhile, an economist’s head sinks into outstretched palms. Here we go again.

Back in the present moment, we’d like to make something super, and abundantly clear. This does not mean to say that, in the UK, we import great masses of American steel. Because, as it happens, we don’t really. We never really have. What this does mean is that for every sneeze in Washington, there’s a global response.

This is not yet another story about tariffs. Not really. It’s a story about ripples. About tremors. Because what might appear a small tremor in one place, may become a landslide in another.

Previously on planet earth

Many of you will remember that this is not our first rodeo with tariffs, particularly those concerning steel. We’ve been here before. 2018 to 2020 saw particular tariff-related volatility, inspired by similar events. Tariffs flew across the Pacific then, too. And prices danced like caffeinated bees.

We in the UK got the ripple effect then, too. An uncomfortable lurching akin to the feeling of being on a boat that’s definitely not sinking, but also definitely not going in an entirely straight line.

Construction output fell then. Some projects stalled. In 2019, the Construction PMI dipped below 50: slowed down, but not quite at panic stations.

There were real-world difficulties. Major projects (like HS2) faced delays. Urban developments got hit by delivery shortages and builders found themselves short on insulation.

And then, came 2020. Wearing a face mask.

Today’s forecast is a little cloudy

We are, again, facing another round of tariffs, and the complications of global trade. Investor confidence is fragile. Project bidding is down. Forecasts are cautious. The Bank of England is still trying to establish if there’s still thunder on the global economy’s horizon.

Plus: our manufacturing PMI has been declining for almost two years. We’re exporting less. Construction forecasts are seeing the shears.

Despite all this: something very interesting is happening.

The home advantage remains

There is undoubtedly quite a lot of panic about global trade. UK buyers are taking a slightly different tread. They’re ordering from inside the country.

Domestic manufacturing orders are up. UK made products are looking like a strong, stable option.

You can wonder amongst yourselves about why this is. We think it’s quite a simple answer. We have much better control over UK products.

UK-made doesn’t just mean shorter lead times or better visibility of supply. It can also mean less exposure to currency volatility, trade disputes, and container ships getting stuck in canals.

It means stability. In a global climate where that’s a rarity, it’s a genuine competitive advantage.

Now, back to us

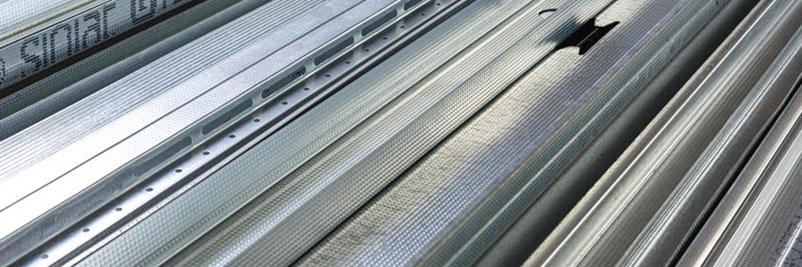

This bit is where we come in. You may’ve heard that we’ve just finished building a new factory. We’ve also been quite outspoken about why we built it.

We have a strong belief in the recovery of the construction market. When it starts to pick up, and it will, we’ll have the capacity to flex up to meet higher demand. That’s not to say that we predicted this, but that we were prepared to be ready. Because we’ve seen these cycles before.

Markets wobble. Supply chains snap. But buildings still need building. And the industry needs to be ready.

What next?

If you’re a buyer, a contractor, a planner - the kind of person who lies awake at night wondering whether their insulation delivery will make it before the scaffolding does – then let this be your moment of clarity.

Don’t wait for things to settle. They may not. Not in a great hurry, anyway.

The best move, the move for stability, is for the construction industry to design its’ future around what we know to be available, and reliable.

Global trade is not likely to get less complicated. But supply chains can.

Bet on the builders

The market will come back. It always does. The question is, when it does, who is going to be ready to deliver?

We will be. We’ll be here. Right where you need us.

Actually, we’ll be in Bristol. With our shiny new plant expansion.

The world wobbles. When we build with foresight, and a little optimism, we’ll be the ones still standing.